Origin Energy is a giant of the Australian energy industry. It is one of the ‘Big Three’ gentailers (alongside AGL and EnergyAustralia), and a key player in Australian liquefied natural gas (LNG). It’s also in the news this week. Private investors may have made a successful offer to take Origin Energy private.

As early as this week, seven months of negotiations could come to a close if Brookfield Asset Management and EIG Partners get a signature on their $18.2B takeover offer. This would bring an end to Origin’s 23 years of public trading in Australia, and split out the two core parts of Origin’s business — power generation and retailing divorcing from the LNG exports.

This week we’re having a look at the energy giant’s history, and what going private might mean for the company and country.

Early origins

Born out of Boral

Origin Energy was created when it was demerged from Boral — now Australia’s largest building and construction materials supplier. Boral is currently the 74th largest Australian company by market capitalisation, valued at $2.84B.1

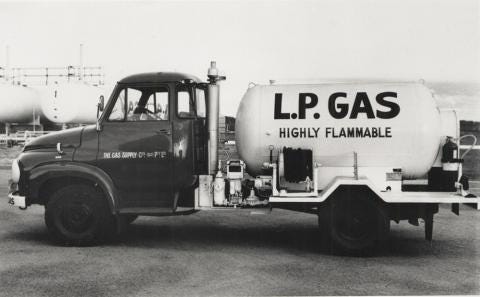

Boral was founded in 1946 as a bitumen and oil refiner. Over the following decades, Boral moved into and out of various industries, eventually growing to have a significant interest in energy. This started in 1963, when Boral purchased the Gas Supply Company — a group of 28 coal gas2 companies spread from Cairns to Portland to Broken Hill. At the time of Boral’s takeover, these companies had been transitioning from coal gas to liquefied petroleum gas (LPG). LPG was a byproduct of the refining Boral did in Sydney, creating some synergies between the business. It also signalled Boral’s move into retailing energy in addition to refining.

In 1968, Boral started its exit from the oil industry by first entering into a joint venture with Total3 on its oil assets, before later selling out its stake. Also in the late 1960s, Boral entered the building and construction materials industry, buying up multiple brickworks and pipe manufacturers. These products would become central to Boral’s corporate strategy to this day.

After the range of acquisitions and investments into new industries, Boral went through a period of consolidation with Boral executives feeling the need to re-focus their strategy. In the late 1990s, it’s tyre business was sold to Bridgestone. Boral shareholders also agreed to separate out and separately list Origin Energy, which started trading as its own entity on 21 February 2000.4

On its own two legs

A few years after splitting from Boral, the demerger would be viewed as a success. Origin Energy grew its position in the energy market, with a focus on vertical integration. That is, developing both the retail side of the business dedicated to selling energy to end-users, and the upstream exploration and production of gas. It also grew its ownership of electricity generation and power networks.

Supporting this growth, Origin committed to a series of acquisitions. This included retail businesses bought from Powercor and CitiPower in Victoria, and Sun Retail in Queensland. It also expanded into coal seam gas exploration. Between the mid 2000s and mid 2010s, Origin grew its power generation developing gas peaking power stations and purchasing Eraring Energy.5 In addition, it purchased 1.6M customer accounts from Country Energy and Integral Energy in NSW.

Liquefied natural gas

Origin also upped its focus on LNG. The investments in LNG would have huge ramifications for the directions of the company. In 2014, the Australian Pacific LNG plant finished construction. This was a massive financial commitment for the company — the debts accrued from this $25B joint venture with ConocoPhillips would force Origin to sell off parts of its business, including its oil and gas arm Lattice Energy which sold to Beach Energy for $1.6B.

Initially, the LNG export terminal struggled as global oil prices crashed in 2015/16. Contracts for LNG are often benchmarked against oil prices, so when oil prices fall, the price LNG is sold at will also fall. However, oil prices and LNG prices later picked up, and APLNG became a major revenue source for Origin. Despite selling down their stake in APLNG (selling 10% to ConocoPhillips for $2B in early 2022), the revenue earned from the project has recently been a boon as their energy markets business struggled.

The State of Origin

Today, Origin Energy is a household name and a mainstay of the energy industry. It employs over 5,000 people and has over 4.5M customer accounts. It owns 6GW of generation, and has contracted for another 1.8GW.

It is also one of Australia’s biggest greenhouse gas emitters. Origin Energy (12.8M tonnes of CO2 equivalent) was the fourth highest emitter after AGL (39.5M tonnes), Stanwell (17.3M tonnes) and EnergyAustralia (16.2M tonnes).6 This is only counting the emissions directly from the fossil fuels Origin Energy burns - it does not count the emissions linked to the gas they dig up and sell.

Incredibly, Origin Energy only owns one renewable generator - Shoalhaven pumped hydro.7 It does not own a single solar or wind farm (although it does have some in development).8 Given Origin Energy’s size, and the rapid growth of utility-scale renewables in Australia, it’s unusual that the energy giant has not developed its own projects. What makes it more unusual is Origin was a fairly early developer of renewables, building and operating the Cullerin Wind Farm in 2009. However, the business pivoted away from direct ownership of renewables, focussing on gas, especially peaking generation which benefits from the volatile nature of the wholesale price in the NEM. Origin is the largest owner of gas turbines in the country.

Origin has faced pressure over its gas strategy. Most recently, it copped flak for its exploration for gas in the Beetaloo Basin. This project was controversial — it would be opening up massive new gas resources at a time when reducing emissions is pretty important9. Origin ultimately sold its stake in the project, although it has still committed to buying gas from the Basin if it is developed.

The takeover

Brookfield’s approaches

Brookfield is the leading party in the bid to take Origin private. However, this isn’t the Canadian multinational’s first foray into Australian energy. In partnership with Double Bay Jesus a.k.a Michael Cannon-Brookes, it put in a bid for AGL. Ultimately, this wasn’t successful. While DBJ has kept his focus on AGL, Brookfield started pursuing Origin Energy.

In August 2022, they approached Origin Energy and asked for a meeting. They offered $9 per share. This offer was later revised down, but only to $8.90, which is likely to appeal to the Origin board and shareholders. Under the proposal, consortium partner EIG Partners would acquire Origin’s gas business, including its 27.5% a stake in Australia Pacific LNG.

Whether the deal goes ahead or not should be known in the next couple of weeks.

What does the takeover mean for Origin?

The takeover would have huge implications for the future of Origin Energy.

Taking a company private introduces a number of changes. Origin would no longer be publicly traded, so there would no longer be an obligation to publish information to the market and respond to investors in public settings. Instead, Origin will have a much smaller group of stakeholders to respond to, which could mean a more streamlined process for setting strategic directions.

And strategic direction is an area where Brookfield has only been too happy to share its ambitions. Brookfield have stated their interests to spend $20B, using Origin Energy as a vehicle to accelerate renewables, with the hopes of turning the energy giant into a clean energy giant.

It would also likely signal the beginning of the end of Origin’s gas-heavy strategy. The LNG component of the business would be split out, and Brookfield would look to diversify away from the gas side of the generation and retail business. Although, from a climate perspective its not clear this is a good thing. When the company was integrated and public, shareholders could put pressure on the business to reduce its emissions. Now, the LNG business will go to a dedicated business, presumably with no qualms about selling gas well into the future.

This was a common concern about the AGL demerger - the most carbon intensive parts of the business would be hived off and AGL could approach investors with a “clean” conscience, but emissions would not fall.

While the takeover is a big deal (literally), the bigger story might be the role of private equity in pushing the transition forward. Publicly traded companies have a fiduciary duty to shareholders, and this could slow or impede a rapid change in company strategy. For AGL, being public has been chaotic — the proposed demerger was scrapped, and now their Board has been shaken up by activist investors. Shareholders have not appreciated any of this and AGL’s share price has been in steady decline over the last 6 years.

By taking Origin Energy private, Brookfield have a vehicle to implement their renewable ambitions. They also get control and ownership over lots of emissions, which they can actively curb. Brookfield also has deep pockets, which can fund the massive transformation of Origin they envisage.

Things happen

Bills go up. The regulated retail electricity prices are expected to jump about 20% from July as wholesale electricity prices are revised upward.

Australia and India look to strengthen economic ties. As countries seek to diversify away from China, India is often touted as the obvious alternative. Australian PM is in India now, and is expected to sign agreements relating to trade and clean energy.

Researchers at Monash University have announced the discovery of a bacteria which converts trace hydrogen in the air into electricity. It’s very early days, but the implications for advanced battery developments could be huge.

Labor’s Safeguard Mechanism legislation is still stuck in the lurch, with neither The Greens or the Coalition supporting it (for very different reasons). So much for the end of the Climate Wars.

Origin Energy is 32nd, valued at $9.9B.

Coal gas is produced by heating coal and adding steam and oxygen to produce hydrogen and carbon monoxide. Coal gas fell out of favour when liquefied natural gas was discovered, which is cheaper and generally won’t accidentally suffocate you in your own home.

Yes, that Total.

Not long after the National Electricity Market commenced. What a coincidence!

Owner of the large eponymous coal-fired power station in the Hunter Valley.

Source: Clean Energy Regulator.

Located in Central NSW, inland of Wollongong.

It has signed long-term power purchase agreements with renewable projects.

Understatement. The project was also linked to a Russian oligarch who has the world’s largest collection of Fabergé eggs.