The NEM - Part 2: How the wholesale market works

A series explaining Australia's National Electricity Market

This is the second post in a series delving into Australia’s National Electricity Market (NEM). The first post provided an overview of the NEM. Now we’re focused on centrepiece of the NEM – the wholesale electricity market (also referred to as the spot market). We’re looking at what it is and how it works, and a subsequent post will explore some of the key design choices.

While this post looks long for a simple explainer, it’s drawn out by lots of graphs! However, substack will probably tell you it’s too long for email. In that case, it’s best to click the link through to a web browser or the substack app to read it there.

Also…

What are markets?

Markets connect buyers and sellers so they can exchange goods and services. Markets can produce information (including prices) which can help coordinate future buyers and sellers.1

Most of us have an inherent understanding of “supply and demand”2 – increasing supply or decreasing demand pushes prices down; decreasing supply or increasing demand pushes price up. And when you draw a graph of supply and demand curves, the intersection tells us the efficient price and quantity for a good/service/commodity. This concept - finding the efficient price and quantity - underlies the wholesale market for electricity in the NEM.

Unlike other markets which can do without it, electricity markets need to have some central coordination. The supply and demand for electricity can’t independently meet up to trade electricity and barter over the price!

The wholesale market for electricity

The wholesale market for electricity is where generators sell electricity to electricity users. Every five minutes of every day, generators will make their offers to sell electricity and when the market clears,3 they get a new set of instructions telling them how much electricity they should generate. This process continually repeats every five minutes. Each five minute window is called a dispatch interval.

The wholesale market has a number of purposes:

Make sure enough generation is produced to meet demand

Produce an electricity price every five minutes, which is used to pay generators and charge electricity users.

Signal to investors the opportunities to make money in the NEM.

To determine an electricity price each five minutes, there are three things we need.

Generator bids

Expected electricity demand

Physical limitations of the power system.

Generator offers

Each day, every large4 generator wanting to sell electricity in the NEM must submit offers (these offers are also called “bids”) to AEMO. These offers detail how much energy they would like to sell and at what price. A generator’s bid is also adjusted for how much of their generation is expected to be lost in the system (for example, a generator way out west would typically have a higher proportion of its generation lost).5

The price generators offer to sell at is not necessarily the price they get paid! All generators that produce electricity in a five minute window get paid at the same price. This price is set by the marginal generator i.e., the most expensive generator dispatched.

Generators get to decide the price they offer electricity at. This decision can be based on factors including:

The costs of operating the generator. Generators that are more expensive to run, such as the turbines that burn gas, will typically offer their generation at higher prices. On the other hand, generators with free fuel (such as solar or wind generators) normally offer their electricity at much lower prices.

The importance of generating in the next five minutes. Some generators really don’t want to have to turn off (that is, have to stop selling their electricity). For some generators, once they are up and running it can be expensive to turn off so they would rather keep generating, even at a loss. To keep generating, they offer electricity at low or negative prices as well.

Opportunity costs. Generators with limited fuel (like hydro or batteries) have to make tricky decisions about the right time to generate. The prices they offer electricity at often reflect the trade-off between using some of their limited fuel now or saving it for some future period.6

Expected demand

As explained in Part 1, one of the quirks of the electricity market is that supply and demand need to be matched in real time. So, in order to decide which generators should generate, the market operator (AEMO) estimates how much demand for electricity there will be in five minutes’ time (i.e. at the end of the dispatch interval). This means trying to forecast the demand for electricity across households, businesses and industry. It’s a challenging job!

AEMO looks at a range of factors for forecasting demand. It looks at electricity demand leading into the five minute window, the weather and historical demand patterns.

Something that helps AEMO is that it knows electrical demand at the start of interval. Because supply and demand are matched, AEMO can look at how much generation is being supplied into the market to know the current level of electrical demand. Knowing what electricity demand is now is the most important variable for forecasting demand in five minutes.

Physical limitations

The last thing that goes into clearing the market are a range of constraints. These are the physical limitations of the system that say things like “this generator can only increase output at this rate”, “this powerline can only transmit so much power” etc.

These limitations make sure that when the wholesale market clears, the outcome is physically achievable. Without these constraints, the market might come up with a lower cost combination of generators, but they might not all actually be able to generate at the same time.

The bid stack and clearing the wholesale market

The AEMO receives all the generator bids7 and combines them into a bid stack (also called the merit order). The bid stack puts all the bids side by side, stacking them from the lowest price to the highest price.

AEMO takes its forecast electricity demand and physical limitations and runs an optimisation engine called NEM dispatch engine (NEMDE). NEMDE’s job is to decide the cheapest combination of generators that are needed to produce the electricity demanded while remaining inside the physical constraints of the power system. NEMDE will output which generators get to generate, how much they’ll generate and the wholesale electricity price.

This process runs every five minutes - remember, these five minute windows are called dispatch intervals. We refer to the generators that are selected in each dispatch interval as being dispatched.

To get the wholesale price, we need to look for the bid from the most expensive generator that is needed in each dispatch interval - this is the bid that sets the clearing price. This is also the price paid to all generators that are dispatched.

Lots of worked examples

Imagine a very simplified version of the NEM. So simplified, we won’t even do maths.

Our base case

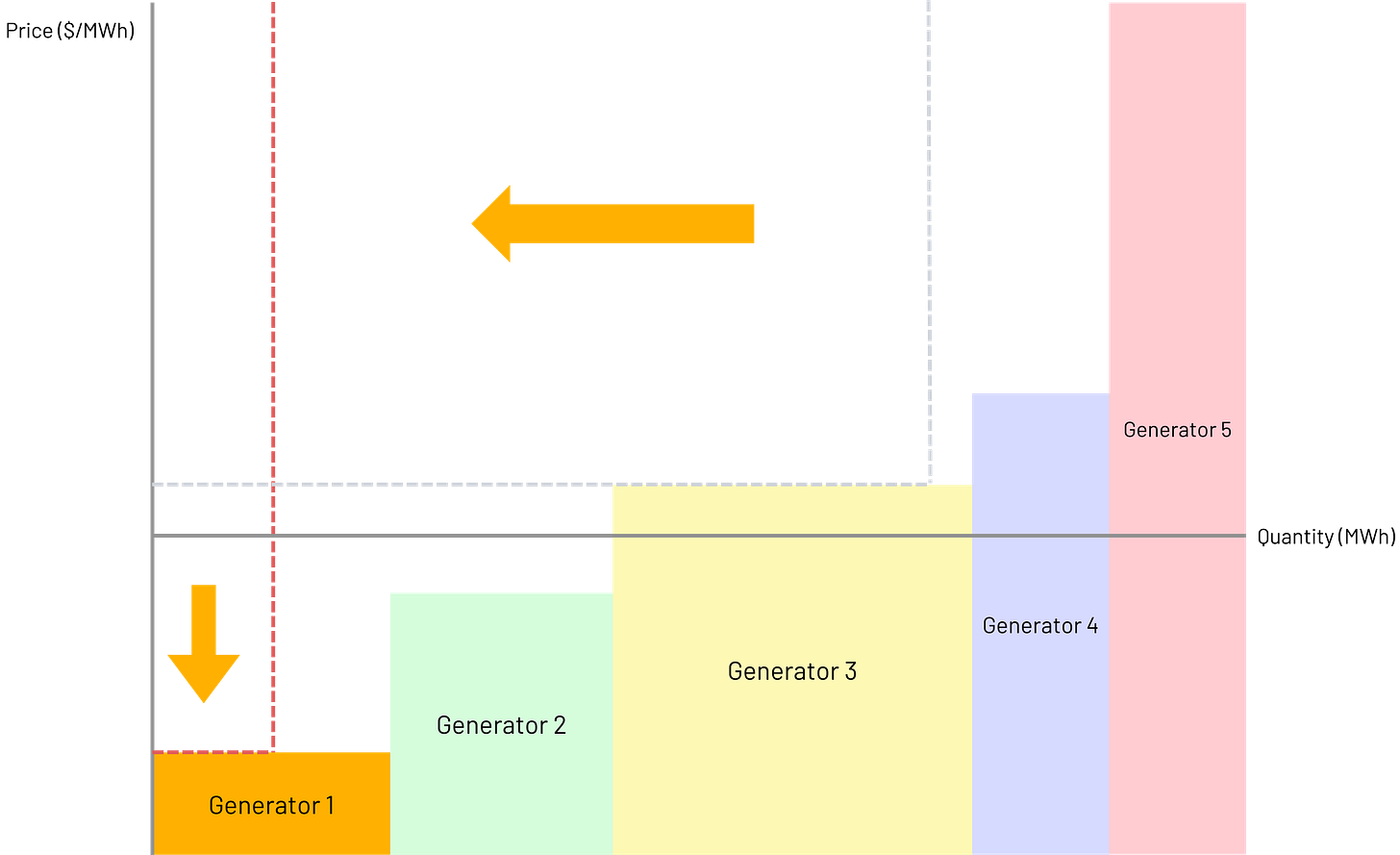

There are five generators who have offered to sell electricity. AEMO has taken their bids and combined them into a bid stack. AEMO has forecast the expected demand at the end of the dispatch interval (we’ll ignore the constraints in these examples). When clearing the market, expected demand intersects with the bid from Generator 3. This means the bid from Generator 3 sets the wholesale price for the dispatch interval. All of the generation capacity offered by Generator 1 and Generator 2 is dispatched, and most of the generation from Generator 3 is dispatched.

What happens if demand is higher?

If AEMO thinks demand is going to be higher than our base case, it means AEMO is going to need more generation. In this case, the increase in demand is big enough that AEMO now needs to dispatch Generator 4 to meet demand. This means Generator 4, a more expensive generator, is setting the price. Generators 1, 2 and 3 are dispatched for all of their available generation and Generator 4 is partially dispatched.

Increases in electricity demand can happen on hot days, when lots of people turn on air conditioning, or coincide with when everyone arrives home from work in the evening.

What if demand falls?

If electricity demand is really low, it means AEMO is not going to need as much generation. In this case, demand is so low that AEMO only needs Generator 1. This large decrease in demand is matched with a large decrease in price.

Electricity demand can fall to be very low because of rooftop solar. Rooftop solar reduces the amount of generation we need from large generators and leads to situations like this - most large generators are not needed and wholesale prices going negative!

What about a fall in supply?

If a generator is not able to offer electricity any more, it leads to a fall in supply. In this case, imagine Generator 2 is a wind farm and it’s not windy in this dispatch interval. In this case, AEMO has to dispatch Generator 1, 3 and part of 4 to meet expected demand. The price offered by Generator 4 sets the spot price for the dispatch interval.

Changes in supply from renewable generation happen all the time. As more of our electricity comes from wind and solar, the amount of generation available in the NEM will vary more over the course of the day. Changes in supply can also happen if a coal-fired power station breaks down, which also happens increasingly often. This is the brave new world we’re rapidly entering!

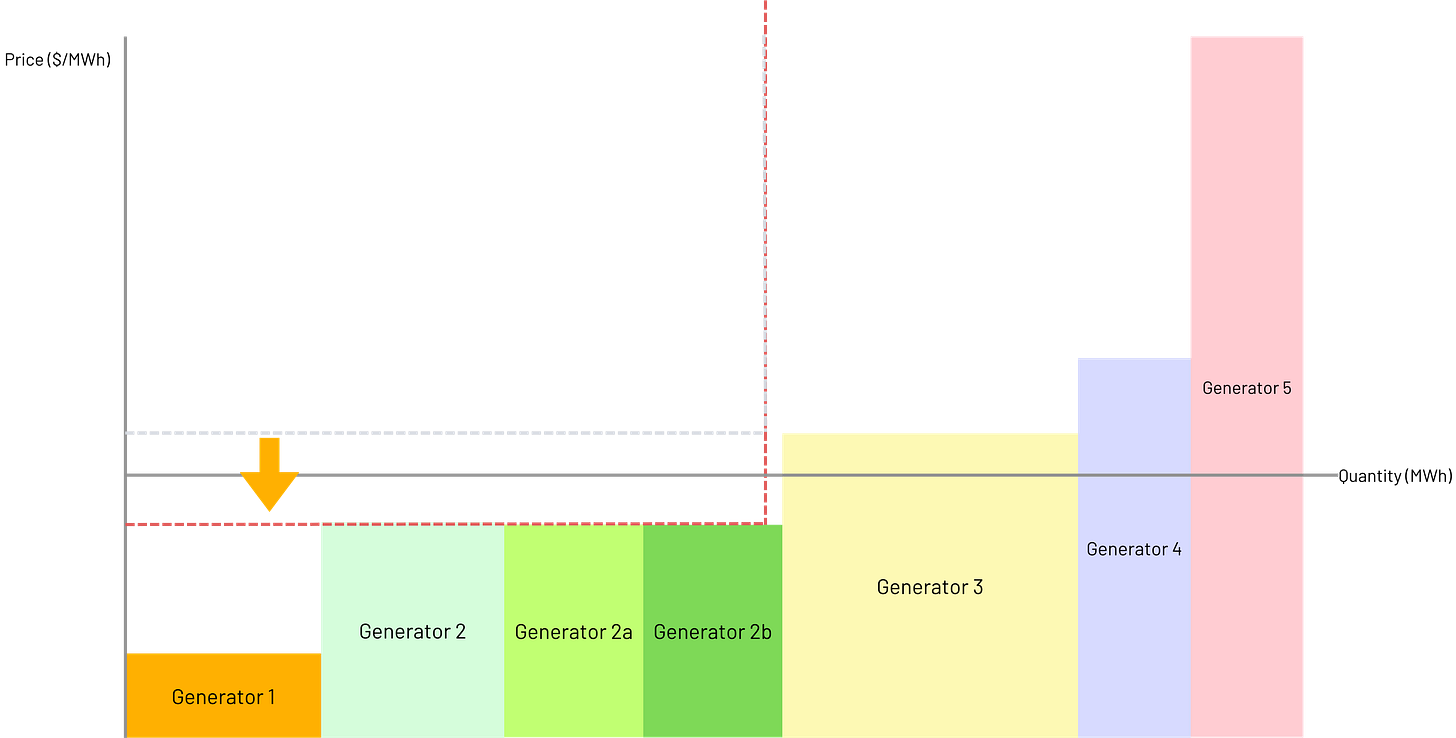

What about an increase in supply?

We can also see increases in generation availability. Imagine Generator 2 represents multiple wind farms, and the wind is blowing something fierce. Now we have more generation available than our base case. Because Generator 2 offers its generation at a low price, it bumps Generators 3, 4 and 5 further to the right in our bid stack. This means AEMO only needs Generator 1 and 2 to meet demand, leading to a fall in the spot price for this dispatch interval.

This is also happening often. On windy and/or sunny days, the spot price for electricity is being pushed down. Often, particularly in the middle of the day when there’s lots of solar, the spot price is negative (meaning generators pay to generate, and consumers get paid to take energy). We’ve written about these negative wholesale prices in the past. In a future post, we’ll talk more about what these prices mean for consumers.

How does the wholesale market make generators compete?

The wholesale market encourages generators to offer their generation at close to the price it costs them to make it (this is called their “short-run marginal cost”).

As we explained above, generators get to decide the price they’ll sell their electricity at, so couldn’t they just increase this price? In a competitive market, this would be a losing strategy.

For example, if it costs a generator $300/MWh8 to produce electricity, they might try offering at a higher price, e.g. $500/MWh. However, this means that when AEMO creates the bid stack/merit order, this generator will have moved to the right. This is what they wanted, but it also means they risk missing out on the opportunity to generate electricity for prices up to $499/MWh.

Returning to the stylised examples, imagine Generator 2 increased its bid hoping to make more money. In this example, now only Generator 1 and 3 are dispatched and Generator 2 can’t generate at a price they’d love to be making!

This process relies on competition in order to work. Without it, there’s no pressure on generators to reel in the prices they offer to sell at. In the next post, I’ll cover what happens when there isn’t enough competition and the price shoots through the roof, including why this is part of the intentional design of the market.

Some of the complexities of the real world wholesale market

Without getting lost in the weeds, there are some complexities that get introduced when we go from our nice simplified NEM into the real world. Some points to note about the actual wholesale market:

Generators and retailers don’t pay each other directly. All of the money in the wholesale market flows through the market operator, AEMO. AEMO is then responsible for making sure everyone pays and gets paid.

Generators get to offer their across 10 different price tranches in each five minute window. A single generator will typically spread their bids with some generation quite cheap and some very expensive.

Generators employ very complex bidding strategies to maximise their profits. This means they’ll do all sorts of strange things which deviate from the simplified examples I’ve used.

Generators can ‘rebid’ where they redistribute their offer tranches in response to a changing market e.g. moving more generation capacity into more expensive tranches in response to hotter than expected day. Regularly tweaking bids through ‘rebidding’ is a big part of effective trading strategies.

The spot price can range from extremely high to extremely low. As we’ll explain next week, there is a good reason for this!

Quick note on the demand side of the market

It might have been bothering some of you that this post has focussed heavily on the supply of electricity, rather than the demand for electricity.9 I’ll talk more about the demand side in a latter part of this series, but it is worth noting some important points here.

Some large loads also make offers to AEMO. This includes when large batteries want to charge, or pumped hydro wants to pump water up hill. These offers are also considered by AEMO when it runs NEMDE and sets the spot price.

End users almost always buy their electricity through an electricity retailer. Electricity retailers pay the spot price for all of the electricity their customers use in each dispatch interval.

And just like generators change their bids when market conditions change, more and more end users are changing their electricity usage based on the spot price for electricity. If this happens on a larger scale, it will create huge benefits for everyone!

End of part 2

Thanks for making it to the end of part 2. This post covered how the wholesale market for electricity works. In the next post, I’ll cover some of the key design choices in the wholesale market.

There are almost infinite resources available if you really want to get more into the theory. If you are a dyed in the wool economist, this section isn’t really for you.

Including those snarky know-it-alls who regurgitate it as an answer to everything…

The market “clearing” is when the intersection of supply and demand curves happens. At this point, we know how much generation is going to be provided for the following five minutes.

These requirements are only placed on large generators - typically over 30MW in capacity (over 3,000 times the size of an average rooftop solar installation).

Energy economist and all-round-great-guy Greg Williams wrote a multi-part series on this topic alone. It’s a fascinating area of the industry and worth reading up on.

Generator offers are called “bids.”

This doesn’t count as maths.

It bothered me! I’m personally very interested in the increased attention levied at energy users and how they can help improve the efficiency of the electricity market. But, this is a whole other kettle of fish.

Agree re your last footnote and IMHO🤔 the fact that virtually from the start of the market it was broken because the market operator had to step in and construct the “wholesale” demand stack. So from the start we have been adding more and more rules to fix the various shortcomings of the “ broken” market. Looking forward to the demand article😁

Super informative gents, keep em coming!